Fcf margin meaning

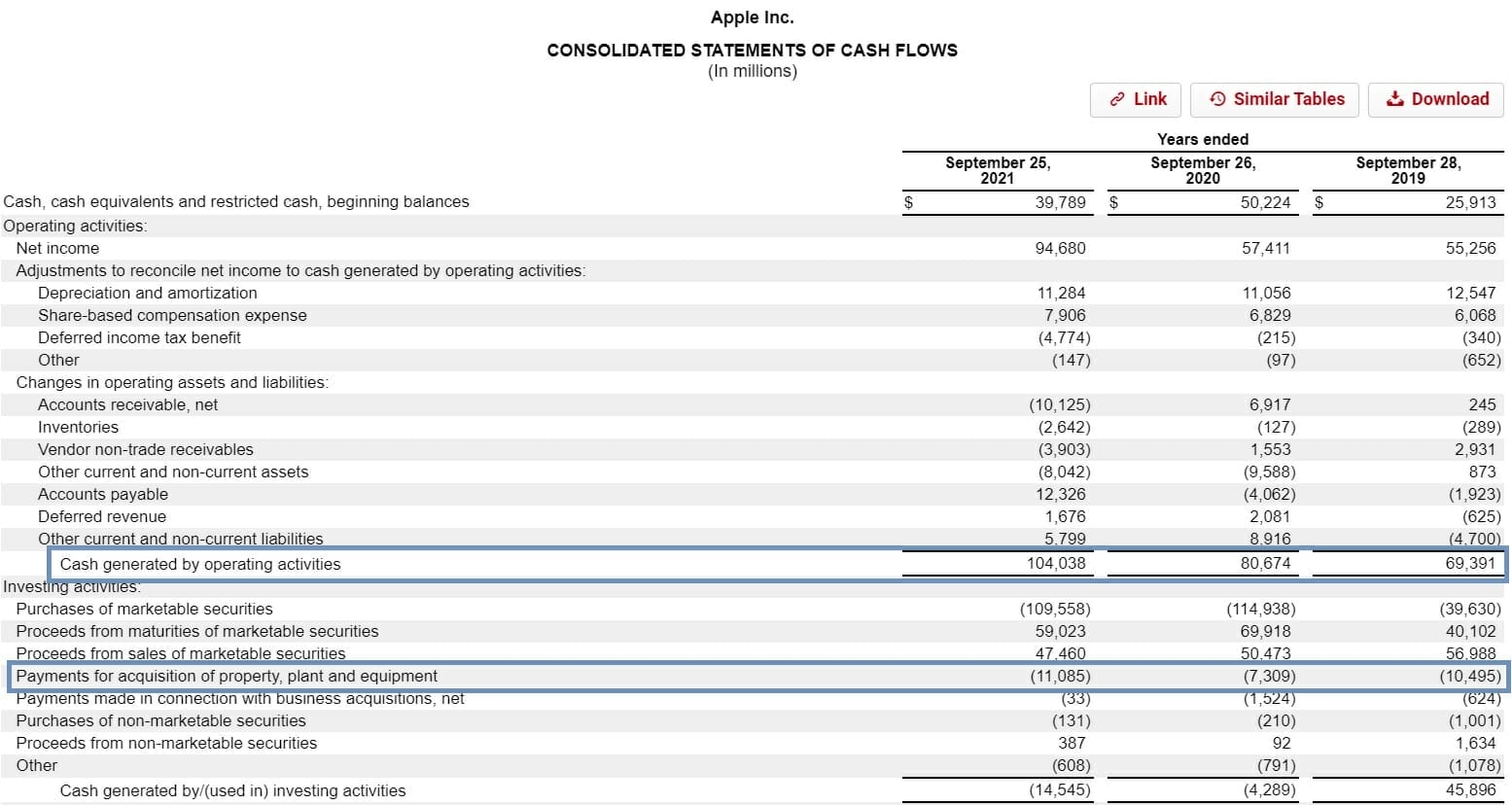

FCF margin is a valuable tool to understanding how much free cash a company can generate from its revenues. Free Cash Flow Margin means the Companys net cash flow provided by operating activities less capital expenditures for a calendar year in the.

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

Unlevered free cash flow can be.

. Unlevered Free Cash Flow - UFCF. NextEra Energy NEE is an American electric utility company with a market capitalization of roughly 163B. Free cash flow is the amount of cash that is available for stockholders after the extraction of all expenses from the total revenue.

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. The net cash flow is the amount of profit the. The more free cash flow a.

Define Maximum FCF Margin. Free cash flow FCF is the money a company has left over after paying its operating expenses OpEx and capital expenditures CapEx. In corporate finance free cash flow or free cash flow to firm is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets.

Threshold FCF Margin means the minimum level of FCF Margin that must be achieved in order for any amount to be earned by the Eligible Executive pursuant to an Award Opportunity. In general a higher FCF Free Cash Flow margin means a. What it ultimately means is that free cash flow yield acts as a positive or negative indicator of how solvent or financially capable a company is should the need arises to access.

Also called Operating Cash Flow Margin and Margin Ratio the Cash Flow Margin measures how well a companys daily operations can transform sales of their products and services into cash. Free Cash Flow Yield. The company reported a positive operating cash flow of.

FCF Margin means the Companys net cash flow provided by operating activities less capital expenditures for the Performance Period expressed as a percentage of the Company s net. When it comes to measuring the performance of a business free cash flow margin is one of the best performance indicators available. Free Cash Flow Margin.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. A new study being released today examines several factors driving cash flow trends including a metric called free cash margin which measures free cash flow as a. Specifically its a profitability ratio indicator.

Free cash flow margin is another cash margin measure where it also adds in capital expenditures. Means the level of FCF Margin beyond which the achievement of FCF Margin will not increase the amount earned by the Eligible Executive pursuant to an Award.

Fcf Margin Jm Finn

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Free Cash Flow Margin Accounting Ratio Gmt Research

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Profitability Metrics Free Cash Flow Margin

Ebit Meaning Importance And Calculation In 2022 Accounting Education Finance Investing Bookkeeping Business

Defining A Good Fcf Margin Formula Basics Examples And Analysis

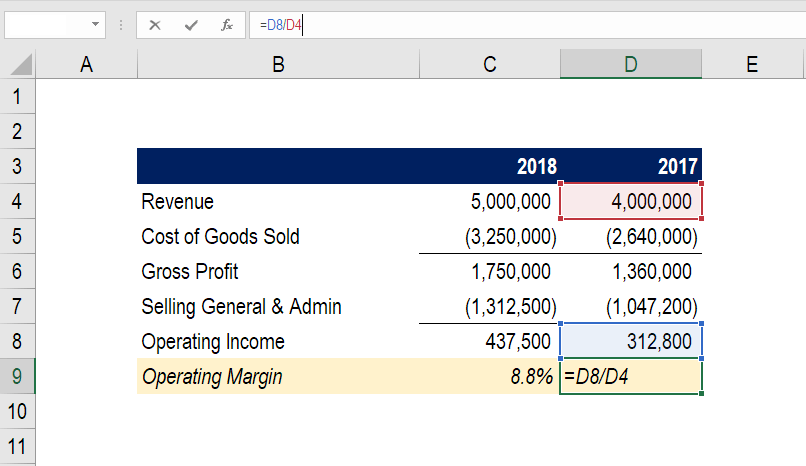

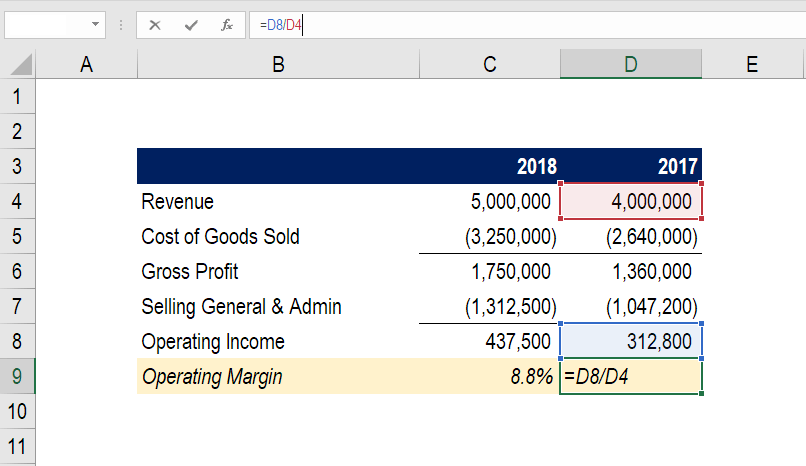

Operating Margin An Important Measure Of Profitability For A Business

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

Profit Margin Formula And Ratio Calculator

Pin On Comparisons

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Defining A Good Fcf Margin Formula Basics Examples And Analysis

How Do Gross Profit Margin And Operating Profit Margin Differ

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Profit Margin Formula And Ratio Calculator

Profit Margin Formula And Ratio Calculator